Project Study

Name: Issa Fares Date: 2024-19-01 Contact: faresissa22@gmail.com

1.0 Executive Summary

This report outlines a strategic Bitcoin mining operation based in Kano, Nigeria, designed for long-term profitability and sustainability through a blend of high-performance mining hardware and renewable energy integration. The operation leverages Bitmain’s Antminer S21 XP Hydro units, known for their energy efficiency and high hashrate performance (473 TH/s per unit). With an initial deployment of 30 units, the farm is engineered to maximize uptime, optimize cooling in a challenging climate, and progressively shift towards solar energy reliance.

A purely initial investment scenario projects a first-year net profit of $145,248 on a total revenue of $275,670, with an annual operating cost of $130,422. When reinvestment strategies are included—particularly the allocation of 85% of monthly profit into operational scaling and solar expansion—the project yields a 3-year net profit of $478,845, with a Return on Investment (ROI) of 68.5%. The solar power share is expected to increase from 60% to 93%, significantly reducing long-term energy costs.

The operation is designed with scalability and regulatory foresight, capitalizing on Nigeria’s recent recognition of digital assets in 2025. This legal backing is expected to enhance investor confidence and open the doors for institutional partnerships. In addition to cryptocurrency mining, the facility is positioned to evolve into a hybrid data center offering services such as edge computing and hosting.

Risks such as regulatory shifts, grid instability, and market volatility are actively mitigated through redundancy planning, energy diversification, and continual technical oversight. The facility’s modular infrastructure, climate-aware design, and strategic location offer long-term viability and opportunities for expansion.

2.0 Introduction

This report outlines the budget for the pilot study of a Crypto mining project. The project involves the construction of a facility from the ground up, incorporating advanced systems for energy integration, cooling mechanisms, and mining. The goal of this pilot study is to validate the feasibility and efficiency of the proposed design.

2.1 Background of Cryptocurrency and ASIC Mining

Cryptocurrency, a form of decentralized digital currency built on blockchain technology, has experienced rapid growth and adoption since the launch of Bitcoin in 2009. At the core of many cryptocurrencies, particularly Bitcoin, is a consensus mechanism known as Proof of Work (PoW), which requires solving complex cryptographic puzzles to validate transactions and secure the network. This process, commonly referred to as mining, demands significant computational power and energy consumption.

To meet these demands, the mining industry has evolved from using standard CPUs and GPUs to deploying specialized hardware known as Application-Specific Integrated Circuits (ASICs). ASIC miners are purpose-built chips designed to execute a narrow set of tasks with unmatched speed and efficiency—in this case, performing SHA-256 hashing used in Bitcoin mining. These devices dramatically outperform traditional hardware in both speed and energy efficiency, making them the industry standard for profitable large-scale mining operations.

2.2 Global trends in crypto mining

Over the last decade, cryptocurrency mining has transitioned into a global industrial operation. Countries like the United States, Russia, Kazakhstan, and China have led in hash rate production due to access to cheap electricity and favorable climates for cooling [Cambridge Centre for Alternative Finance, 2023]. However, rising regulatory scrutiny and environmental concerns have pushed the industry to seek more sustainable energy sources.

A notable trend is the integration of renewable energy, particularly solar and hydro, into mining infrastructure to reduce carbon footprints and maintain profitability. Furthermore, the industry has shown a shift toward modular mining units like Bitmain’s Antbox containers, which offer scalability, rapid deployment, and improved thermal management.

2.3 Project scope

This business study proposes the development of a solar-powered, containerized ASIC mining facility in Kano, Nigeria, utilizing Bitmain’s ANTSPACE HW5 modular hydro-cooling data center and Antminer S21 XP Hyd units. The ANTSPACE HW5 is a high-performance, closed-loop liquid cooling container capable of hosting up to 210 hydro-cooled miners per unit, offering exceptional energy efficiency and thermal stability in hot climates.

The mining facility will be powered by solar photovoltaic (PV) for 60% of its energy requirements which will further be increase with capital re-injection, with additional energy storage and a UPS (uninterruptible power supply) system to ensure continuous operations during nighttime or periods of low solar irradiance. Given the high temperatures and dust levels characteristic of Northern Nigeria, hydro cooling offers a more reliable and efficient solution than traditional air cooling, significantly reducing the risk of thermal throttling and downtime.

This report provides a comprehensive analysis of the project’s technical, environmental, and financial feasibility. It covers the infrastructure and energy requirements, cooling design, capital and operational expenditures, local regulatory considerations, and projected return on investment (ROI). The project aims to showcase a clean, scalable, and profitable crypto mining model that leverages Nigeria’s abundant solar resources.

3.0 Project Design

Description

The building structure will be constructed from the ground up, designed to accommodate the batteries module, office, water filtration and cooling system, and the HVAC system. It will include reinforced foundations, walls, and roofing to support the weight of the infrastructure and ensure durability.

3.1 General Infrastructure

3.2 Mining Infrastructure

3.2.1 Use of Bitmain Antbox / Modular Containers

The project will utilize Bitmain’s ANTSPACE HW5 (Hydro Cooling Data Center), a state-of-the-art, containerized data center specifically engineered for hydro-cooled ASIC mining hardware. Each HW5 unit supports up to 210 Antminer Hydro units and is fully integrated with internal water circulation, heat exchangers, and power distribution systems.

The choice of the HW5 is based on several key advantages:

-

Optimized Cooling Performance: The hydro-cooling system ensures stable miner operation in high-temperature environments such as Kano, Nigeria, where ambient temperatures can exceed 40°C. Water cooling drastically reduces heat buildup, ensuring higher miner uptime and performance consistency.

-

Dust and Debris Protection: Compared to air cooling, hydro-cooling minimizes exposure of internal electronics to environmental dust, which is common in Northern Nigeria due to the Harmattan season.

-

High Density, Small Footprint: The container form factor allows easy transportation and compact deployment, ideal for modular growth without large infrastructure investment.

-

Pre-engineered for S21 XP Hyd Compatibility: The HW5 is designed to support the high power and cooling needs of Bitmain’s latest hydro miners, ensuring seamless integration.

3.2.2 ASIC Miner Selection

The selected ASIC model is the Bitmain Antminer S21 XP Hyd, a high-efficiency, hydro-cooled miner capable of delivering up to 473 TH/s with an energy efficiency of 12 J/TH, making it one of the most cost-efficient options available.

Due to capital constraints and a strategic decision to scale operations sustainably, the initial deployment will consist of:

-

1 x ANTSPACE HW5 container [1]

-

Up to 30 x Antminer S21 XP Hyd units (14.28% of HW5 full capacity)

This phased approach allows the business to manage initial capital expenditure while preparing the infrastructure for future expansion. The remaining capacity within the container will be populated in future procurement cycles using returns generated from the initial deployment.

Why S21 XP Hyd?

-

Best-in-class energy efficiency lowers operational costs and increases BTC mined per watt.

-

Hydro cooling compatibility with the HW5 eliminates additional cooling infrastructure costs.

-

Long-term ROI: High hash rate-to-power ratio extends the economic lifespan of each unit, even during periods of low Bitcoin price or high difficulty.

3.2.3 Deployment Scale and Strategy

The deployment will begin with one modular unit, designed to operate semi-autonomously with minimal on-site staff. As profits are realized, the solar setup will be expanded to boost its contribution from the initial 60% to 97% in 11 months.Following that, additional S21 XP Hyd units will be procured to fill the HW5 to full capacity based on performance and reinvestment metrics.

The container will be:

-

Installed on pre-prepared concrete pads with integrated utility access

-

Connected to a dedicated solar PV array and battery storage system

-

Managed via centralized remote monitoring software provided by Bitmain or third-party integrators

3.3 Cooling System

The cooling system is a critical aspect of any high-density ASIC mining deployment, especially when targeting performance optimization, energy efficiency, and equipment longevity. For this project, the Bitmain ANTSPACE HW5 container solution has been selected due to its integrated hydro-cooling architecture, which supports the Antminer S21 XP Hydro series.

3.3.1 Hydro-Cooling Loop Design

The ANTSPACE HW5 employs a closed-loop water cooling system, which circulates coolant (typically purified water or a water-glycol mixture) through internal piping that interfaces directly with the miners’ cold plates. Heat is absorbed by the water and transported outside the container to a dry cooler (radiator system), where it is dissipated into the air before returning to the container for re-circulation.

-

This configuration offers several benefits over traditional air-cooled or immersion-cooled solutions:

-

Significantly higher thermal efficiency, allowing for higher hash rate operation with lower failure rates.

-

Fully enclosed and isolated system, reducing dust ingress, corrosion, and noise.

-

Modular design, enabling outdoor deployment in remote or industrial zones.

Each HW5 container supports approximately 1200Kw of mining capacity, and the internal loop is designed to minimize fluid loss, although regular inspection and topping up are required.

3.3.2 Water Supply and Quality Management

Although the hydro-loop is sealed, it requires an initial charging volume of purified water, as well as periodic top-ups to compensate for evaporative losses or system maintenance. Importantly, Bitmain and other hardware manufacturers explicitly recommend the use of deionized or distilled water to prevent:

-

Scale buildup in heat exchangers (from calcium or magnesium)

-

Electrochemical corrosion from high ionic content

-

Biofouling, which can block pipes and reduce cooling efficiency

Given that the proposed deployment site is in Kano, Nigeria — a region where groundwater (borehole) sources often exhibit high mineral content and microbiological load — direct use of untreated water is not viable. Instead, an on-site Reverse Osmosis (RO) treatment system is proposed.

3.3.3 Water Treatment System Design

The proposed treatment train is as follows:

-

Borehole Intake – Provides raw water input.

-

Sediment Filtration (5–20 micron) – Removes sand and suspended solids.

-

Activated Carbon Filtration – Removes chlorine, organic matter, and odors.

-

Antiscalant or Softener – Prevents mineral scaling of RO membrane.

-

Reverse Osmosis System – Produces purified water with low conductivity and low TDS (<10 ppm).

-

UV Sterilization or Ozone Disinfection – Optional microbial control.

-

Storage Tank (1,000–2,000 liters) – To buffer treated water for system fill-ups and maintenance.

-

Delivery Pump – Feeds treated water into the HW5 container as needed.

The RO system need not be continuous-flow and can be designed to produce 300–500 liters/day, sufficient to meet the initial fill and top-ups.

3.3.4 Maintenance and Monitoring

To ensure consistent cooling performance and system health:

-

Water conductivity, temperature, and flow rate will be monitored continuously via sensors.

-

Filter cartridges (pre-RO) will be replaced monthly or as required.

-

The dry cooler will be maintained periodically to ensure unrestricted airflow and fan performance.

-

Water quality testing will be performed quarterly to validate purification system output.

This integrated approach to hydro-cooling and water purification is designed to ensure optimal ASIC performance, minimal downtime, and long-term operational sustainability — all while maintaining a compact environmental footprint suitable for deployment in northern Nigeria.

3.4 Power System

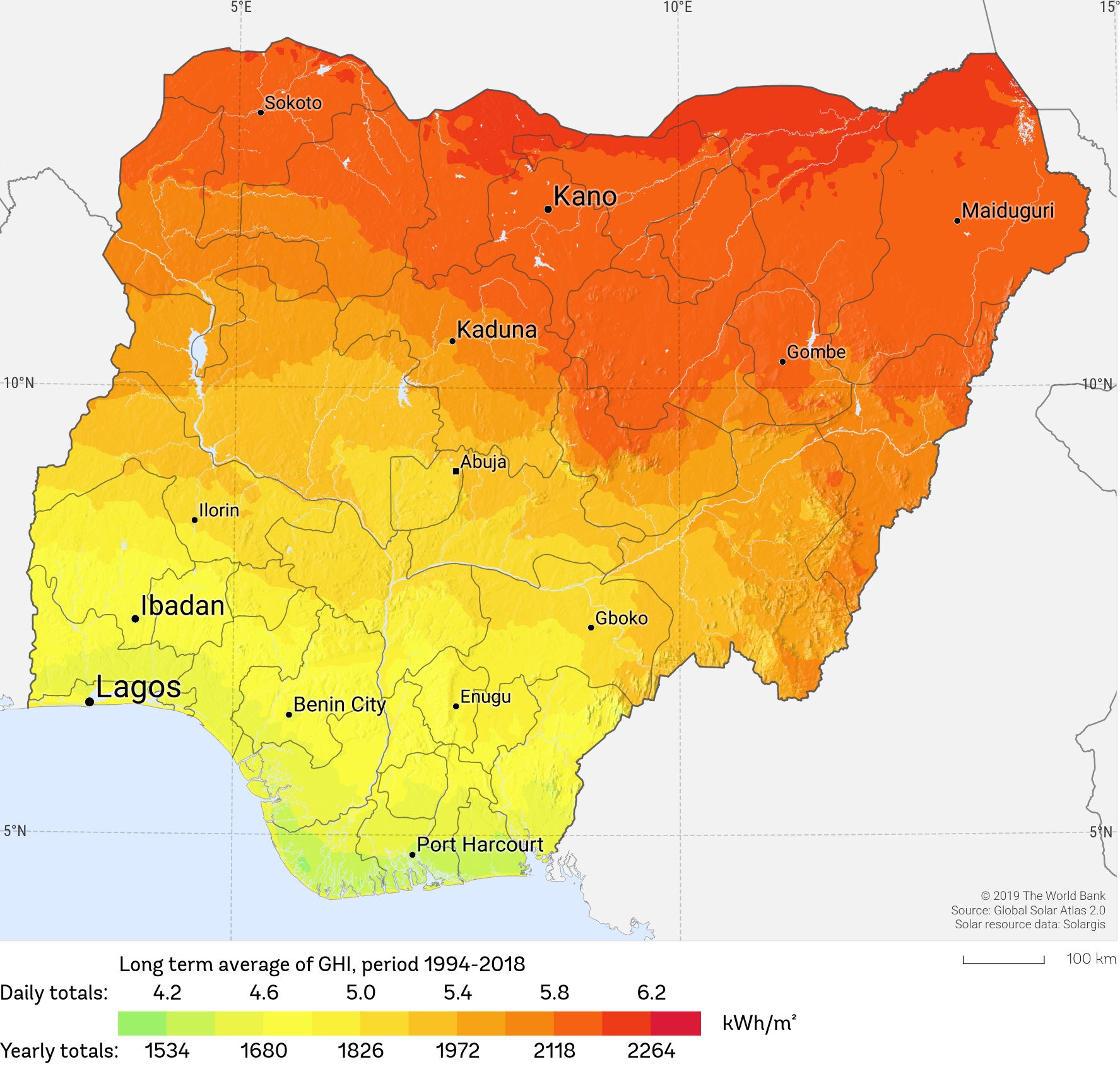

A robust and efficient power infrastructure is paramount for the continuous operation of high-density ASIC miners. Leveraging Kano’s high solar irradiance, this project adopts a hybrid energy solution combining solar photovoltaic (PV) generation, battery energy storage systems (BESS), uninterruptible power supply (UPS), and a diesel generator for backup.

3.4.1 Load Profile and Total Power Demand

The deployment includes 30 Antminer S21 XP Hyd units, each consuming approximately 5.7 Kw under optimal hydro-cooled conditions.

Total ASIC Power Load:

30 units × 5.7 Kw = 171 Kw

Including Cooling Systems, RO Units, and Safety Margin (~10%):

Total Continuous Load ≈ 188 Kw

3.4.2 Solar Farm Design

Kano benefits from an average of 7.0 Peak Sun Hours (PSH) per day, making it ideal for solar energy generation. [8]

Daily Energy Requirement:

188 Kw × 24 hours = 4,512 Kwh/day

Solar Generation Target (Daylight Hours):

only 60% of the energy will be sourced from solar energy for starters, while the rest will be procured from KEDKO. thus, to meet the daily demand during daylight:

(4,512 Kwh x 60/100) ÷ 7.0 PSH ≈ 386.7 Kw (DC Capacity)

Panel Rating: 610 W (monocrystalline)

Number of Panels Required:

386.7 Kw ÷ 0.610 Kw/panel ≈ 635 panels

Land Requirement:

Assuming a 5x10 grid of panels each with the dimensions of width 1.2m, length = 2.4m per panel angled at 25 degrees from the horizontal, and a grid spacing of 2.2m as seen in figure 9 Below:

grid length (width spacing) = (2.4m x 10 panels) + 1.1 = 25.1m

grid width (width spacing) = (1.2m x 5 panels x cos(25)) + 1.1 = 6.54m

Area of grid (50 panels)= total grid length x total grid width ≈ 164.1 m²

total required area = Area of grid x (635 panels / 50 panels per grid)

total required area = 164.1 m² x (635/50) ≈ 2,084 m² (~0.5 acres)

3.4.3 Batteries

Energy storage Requirement:

- The total energy required continuously is 4,512 Kwh, but since only 60% will be provided by solar panels as mentioned earlier, only 2,707.2 Kwh need to be evaluated.

- The energy produced during the 7 hours of peak solar hours daily will be used up directly and does not require storage, thus energy to be stored is:

Total Energy stored = total solar energy - (total power required × 7 PSH)

Total Energy stored = 2,707.2 - (188 Kw × 7 PSH) = 1,391.2 Kwh

Including 10% Buffer for Inefficiencies during charge/discharge cycles:

1,391.2 Kwh / 0.9 = 1,545.8 Kwh (~1.55 MWh)

Battery Selection:

-

Type: Lithium Iron Phosphate (LiFePO₄)

-

Advantages: High cycle life, thermal stability, safety

Battery Module Configuration:

Module Capacity: 215 Kwh

Number of Modules Required:

1,545.8 Kwh ÷ 215 Kwh/module ≈ 7.18 → 8 modulesSystem Layout:

- Modular racks with integrated Battery Management Systems (BMS)

3.4.4 Inverters

- The inverter rating should be above the total Continuous Load by a small margin.

- For easier integration down the line, the system will have multiple inverters connected and working in parallel Inverter starting Selection:

- 1 Inverter rated for continuous 150 Kw, 3-phase, 400 V output

- 1 Inverter rated for continuous 50 Kw, 3-phase, 400 V output

3.4.5 Diesel Generator Backup

Apparent Power Required (Kva):

Apparent Power = (power required x generator Redundancy Factor) / generator power Factor;

Apparent Power = (188 x 1.15) / 0.9 ≈ 240.2 Kva

-

Configuration: 1 × 250 Kva diesel generators (N+1 redundancy)

-

Features:

- Auto-start capability

- Fuel-efficient operation

-

Usage Scenario: Extended cloudy periods, maintenance downtime, or emergency situations

3.4.6 Transformers

Step-Up Transformer: 400V to 11kV for grid integration Facilitates energy export and grid support

- Assuming a typical power factor of 0.9 for mining equipment

- Targeting 80% of full capacity for continuous loads

Apparent Power (Kva) = Real Power (Kw) / (Power Factor (PF) x (working Capacity Percentage / 100))

Apparent Power (Kva) = 188 / (0.9 x (80 / 100))

Apparent Power (Kva) = ~261 Kva

Transformer Selection:

-

Capacity: 300 Kva

-

Primary Voltage: 11 kV

-

Secondary Voltage: 400 V (3-phase)

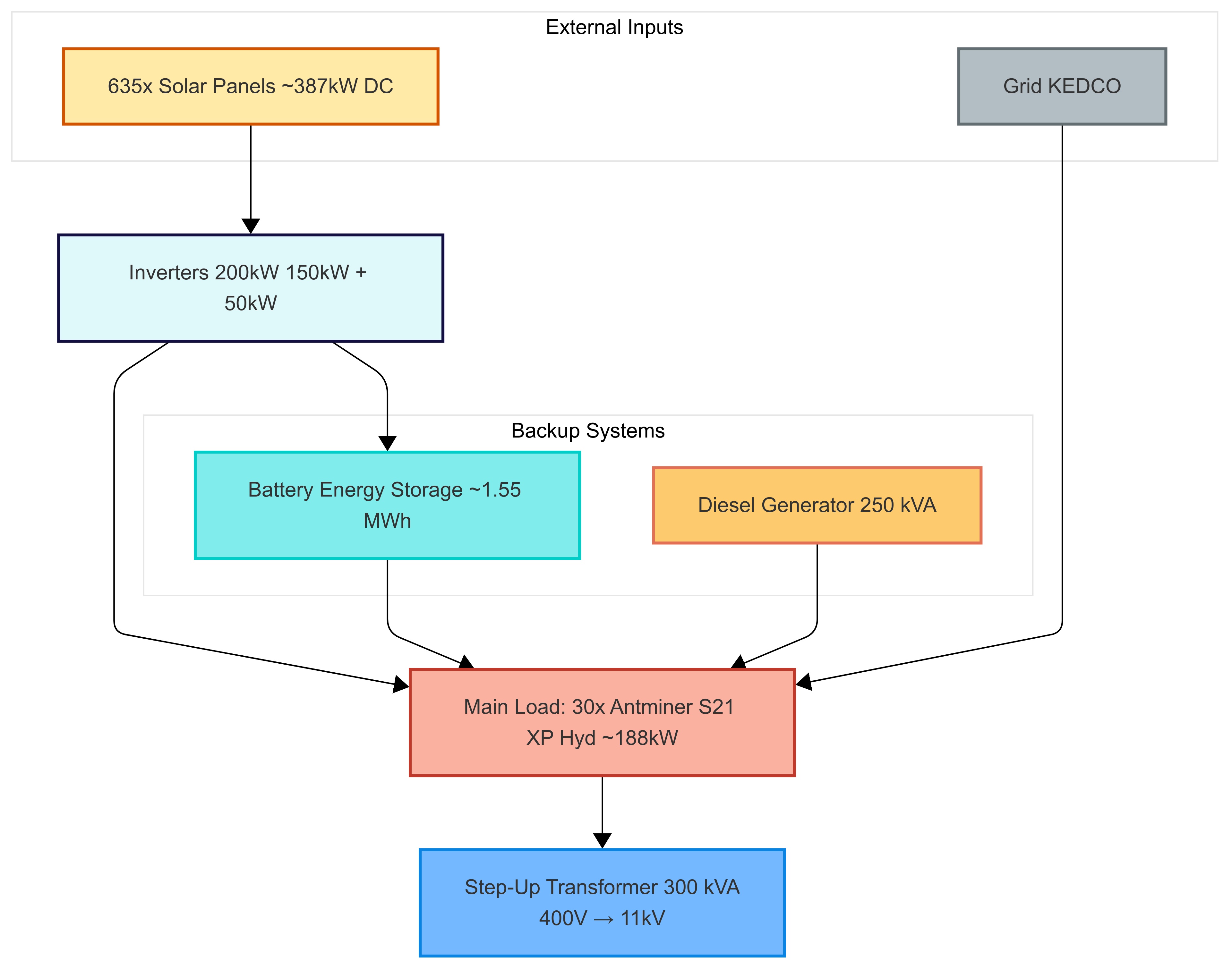

3.4.7 Visual Diagrams and Layout

To aid in visualization, the following schematic illustrates the integrated power system:

This diagram showcases the flow from solar panels through inverters, battery storage, and load distribution, including backup systems.

Summary of Power System Specifications

| Component | Specification |

|---|---|

| ASIC Load | 171 Kw |

| Total Load w/ Cooling | ~188 Kw |

| Solar Capacity | ~387 Kw (DC Capacity), ~635 panels |

| Battery Storage: | ~1.55 MWh LiFePO₄ (8 modules of 215 Kwh) |

| Inverters | 200 Kw, 3-phase, 400 V output |

| Generator Backup | 1 × 250 Kva Diesel (N+1 Redundancy) |

| Transformer | Isolation (off-grid) / Step-Up 400V→11kV (grid-tied) |

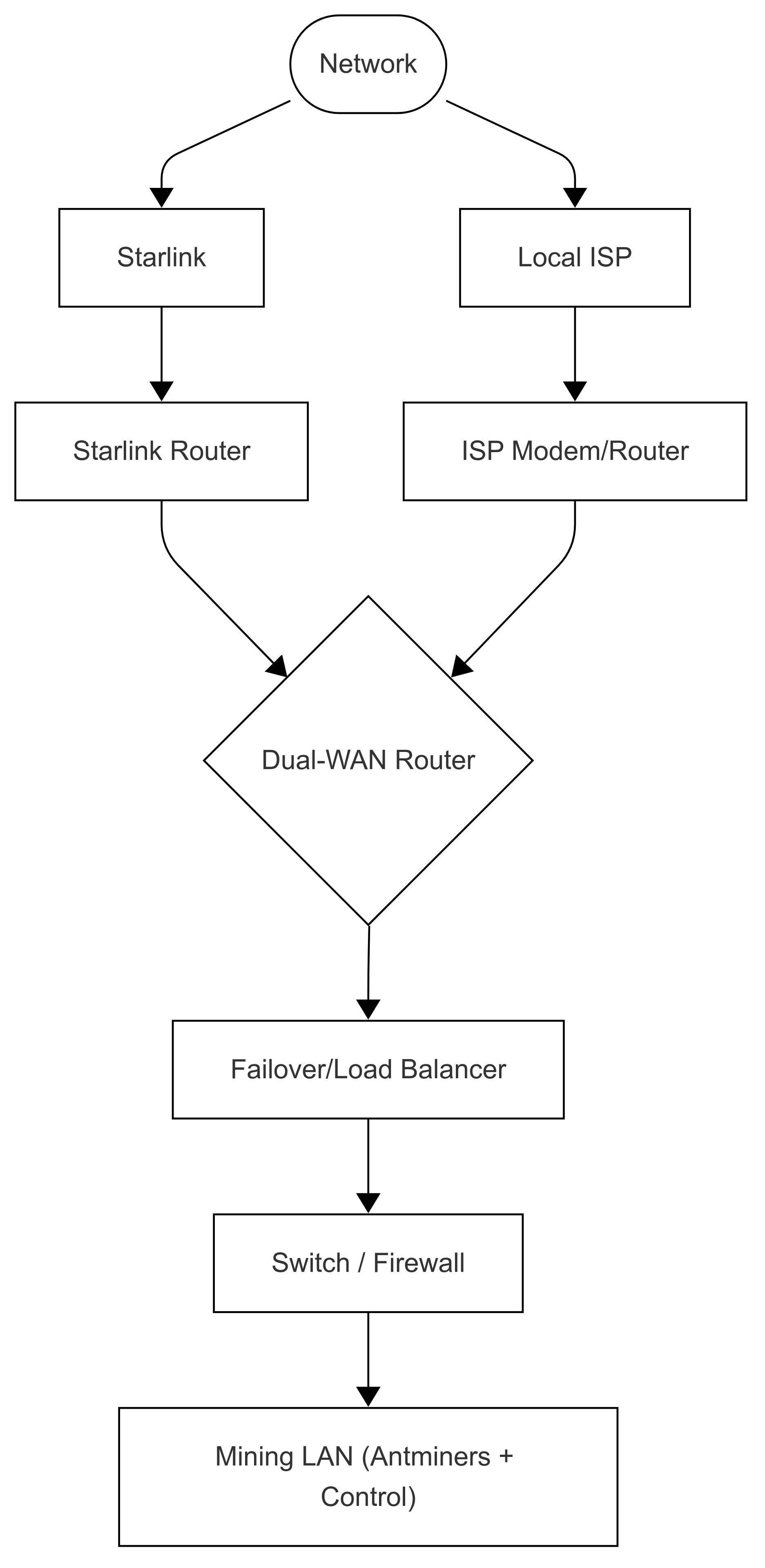

3.5 Network setup

-

Starlink Setup

-

Starlink Dish (Outdoors)

-

Starlink Router (bridged mode or via Ethernet Adapter)

-

Supplies internet via Ethernet

-

-

Local ISP Setup

-

Fiber, LTE, or microwave modem/router

-

Also outputs via Ethernet

-

-

Dual-WAN Router (Main Brain) Use a router that supports automatic failover + load balancing. Good examples:

-

Ubiquiti EdgeRouter

-

TP-Link ER605

-

MikroTik hEX S

-

Peplink Balance

Functions:

-

Monitors both WANs

-

If local ISP fails → automatically routes traffic to Starlink

-

Can balance traffic across both if desired (non-mining traffic, updates, etc.)

-

-

Switch & LAN

- Gigabit Ethernet switch

- Connects miners, NMS (network management system), local control PC

Optional: Firewall / VPN

-

For secure remote access, use:

-

A small firewall appliance (like pfSense or OPNsense)

-

VPN tunnel for remote monitoring

Benefits of This Structure

-

High Uptime: One link goes down, the other takes over

-

Performance: Can load-balance software updates or background tasks to avoid blocking mining traffic

-

Scalability: Easily extendable as you grow from 100 to 300+ miners

4.0 Financial Analysis

4.1 Capital Expenditure (CAPEX)

This section details the initial capital investment required to deploy the ASIC mining project. Costs are estimated based on standard international and Nigerian market prices as of 2024–2025, including logistics and engineering.

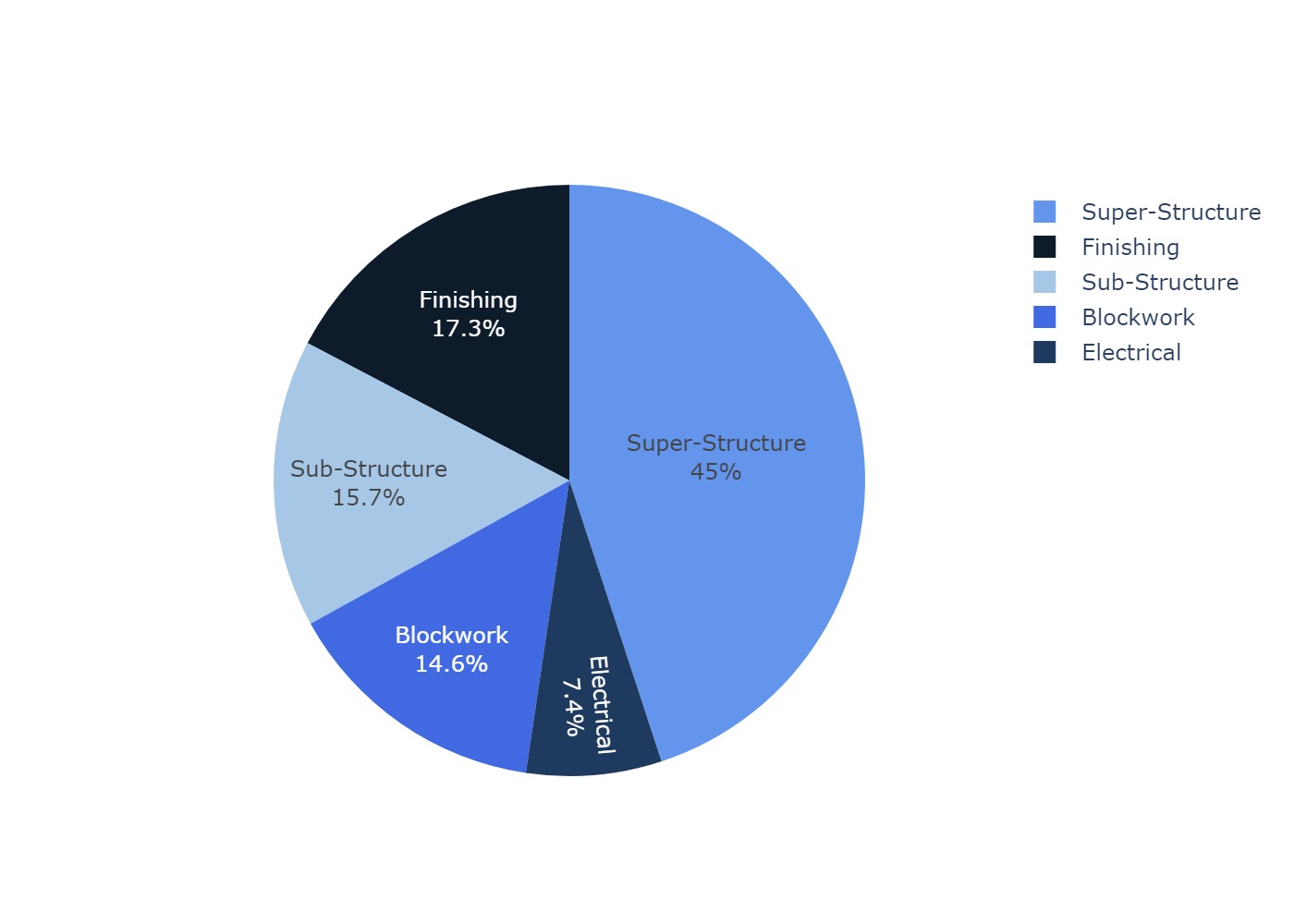

4.1.1 Site Preparation and Construction

| Sub-Structure (₦9,897,800) | Super-Structure (₦28,281,000) | BlocKwork (₦9,188,500) | Electrical (₦4,652,500) | Finishing (₦10,889,500) |

|---|---|---|---|---|

| Site Clearing | Formwork to Columns and Beams | Block to Headcourse | Electrical Piping and Wiring | Plastering of Walls Both Faces |

| Excavation of Foundation | Casting to Columns and Beams | Fixtures and Fittings | Dressing of Doors and Windows | |

| Starter: Columns and Base | Formwork to Headcourse | Epoxy Flooring | ||

| Casting of Foundation | Rebar to Headcourse | Site Clearing to Handover | ||

| BlocKwork Filled Solid | Rebar to Column and Beams | |||

| Casting of Starter Column | Casting of Headcourse | |||

| Hardcore Filling and Compaction | Formwork to Suspended Roof | |||

| Damp Proof Course (DPC) | Rebar to Suspended Roof | |||

| Casting of Suspended Roof |

| Description | Unit | Qty | Unit Price (₦) | Total (₦) | |

|---|---|---|---|---|---|

| Reinforcement | Y16 for Columns | Units | 67 | 22,700 | 1,520,900 |

| Y16 for Beams | Units | 310 | 22,700 | 7,037,000 | |

| Y10 for Stirmp | Units | 50 | 8,700 | 435,000 | |

| Blocks | Units | 12,522 | 700 | 8,765,400 | |

| Reinforcements | Y12 for Slab | Units | 420 | 12,300 | 5,166,000 |

| Cement | BlocKwork | Bags | 140 | 9,500 | 1,330,000 |

| Casting of Columns | Bags | 64 | 9,500 | 608,000 | |

| Casting of Slab | Bags | 350 | 9,500 | 3,325,000 | |

| Casting of Beams | Bags | 150 | 9,500 | 1,425,000 | |

| Casting of DPC | Bags | 360 | 9,500 | 3,420,000 | |

| Casting of Binding | Bags | 150 | 9,500 | 1,425,000 | |

| Casting of Plaster | Bags | 200 | 9,500 | 1,900,000 | |

| External Plaster | Bags | 200 | 9,500 | 1,900,000 | |

| Marine Boards | Units | 490 | 26,500 | 12,985,000 | |

| Bamboo | Units | 300 | 2,300 | 690,000 | |

| Braces | 2x3 | Units | 500 | 200 | 100,000 |

| 2x4 | Units | 500 | 200 | 100,000 | |

| Nails | 3 Inch | Bags | 9 | 33,000 | 297,000 |

| 6 Inch | Bags | 6 | 35,000 | 210,000 | |

| Sand | Plaster Sand | Trips | 14 | 130,000 | 1,820,000 |

| Sharp Sand | Trips | 14 | 140,000 | 1,960,000 | |

| Gravel | Size 3/4 | Trips | 8 | 430,000 | 3,440,000 |

| Laterite | Trips | 15 | 70,000 | 1,050,000 | |

| Total | 60,909,300 | ||||

- Subtotal: ≈ ₦62,909,300(Including Labour)

4.1.2 Office and lab equipments

| Location | Item | Qty | Unit Price (₦) | Amount (₦) |

|---|---|---|---|---|

| Office | Office Chair | 3 | 65,000 | 195,000 |

| Office Table | 2 | 120,000 | 240,000 | |

| Cabinet | 1 | 150,000 | 150,000 | |

| Seating Area | 1 | 150,000 | 150,000 | |

| Computer | 2 | 400,000 | 800,000 | |

| Lab | Chemical Equipments | 1 | 500,000 | 500,000 |

| Laboratory Workstation | 1 | 850,000 | 850,000 | |

| Misc | - | - | 200,000 | |

| Total | 3,085,000 | |||

4.1.3 Bitmain Containers and ASICs

-

ANTSPACE HW5 Hydro Cooling Container

-

Each container holds up to 210 miners (the project aims to start with 30 units, allowing future expansion).

-

Cost Estimate: ~$84,000(container only) [1]

-

-

Antminer S21 XP Hyd (473 TH/s @ 5676W)

-

Unit Cost (bulk rate): ~$10,170 per unit × 30 = $305,100 [2]

-

Power Draw: ~170.28 Kw total for 30 units

-

Crypto algorithmcoins: SHA256 BTC/BCH/BSV

-

Comes with hydro cooling blocks integrated

-

-

Subtotal: ≈ $389,100

4.1.4 Batteries, Solar Panels, Inverters, Transformers, and Generator

Batteries:

- Industrial-grade LiFePO₄ (215 Kwh/module) with integrated BMS and rack housing

- Market Rate : $16,500 per battery [3]

- Subtotal: 8 batteries × $16,500 ≈ $132,000

Solar Panels:

-

610W panels → need ~635 units

- Price per panel (uninstalled): ~$51.24 [4]

-

with racking and installation estimated at 10%, price (installed): $57

- Subtotal: $36,195

Inverters:

- 1 x ATESS HPS Series, 150Kw Inverter Commercial-grade,hybrid inverter at 20600 [5]

-

1 x ATESS HPS Series, 50Kw Inverter Commercial-grade,hybrid inverter at 8600 [5]

- Subtotal: $29,200

Transformers:

- 1 x 11kv 3-phase transformer

- Subtotal: $4,950 [6]

Generator:

- 1 × 250 Kva diesel generators (N+1 redundancy)

- Subtotal: $13,000 [7]

TOTAL: $215,345

4.1.5 HVAC cooling

| Item | Model | Qty | Description | Capacity (Kw) | Unit Price ($) | Total Price ($) |

|---|---|---|---|---|---|---|

| VRF Outdoor Units | ||||||

| 1 | 4TVVT192DD07CAA | 1 | Trane/20HP TVR 7G Modular Cooling Only | 56.00 | 7,011.49 | 7,011.49 |

| VRF Indoor Units | ||||||

| 2 | 4TVBD009AB07RAA | 1 | Trane TVR 7G Compact Four-way Cassette Unit | 2.80 | 395.78 | 395.78 |

| 3 | 4TVCD038AB07RAA | 1 | Trane TVR 7G Four-way Cassette Unit | 11.20 | 704.10 | 704.10 |

| 4 | 4TVCD055AB07RAA | 3 | Trane TVR 7G Four-way Cassette Unit | 16.00 | 880.91 | 2,642.74 |

| Branch Distributors & Accessories | ||||||

| 5 | 4TV0RDK01CA007G | 1 | Trane/IDU Y Joint, Kw < 22.4 | - | 34.69 | 34.69 |

| 6 | 4TV0RDK03CA007G | 3 | Trane/IDU Y Joint, 33≤ Kw < 104 | - | 69.96 | 209.87 |

| Total Price (USD) | $10,998.67 | |||||

| Total Price (NGN) | ₦17,597,866.00 | |||||

| VAT (7.5%) | ₦1,319,839.95 | |||||

| Grand Total | ₦18,917,705.95 | |||||

4.1.6 Liquid Cooling System Setup for miners

| Component | Quantity | Unit Price (₦) | Total (₦) |

|---|---|---|---|

| 120m 1 inch PVC pipe | 50 | 2,200 | 110,000 |

| 40m 1/2 inch PVC pipe | 15 | 1,800 | 27,000 |

| Stainless steel 2mm | 10 | 150,000 | 1,500,000 |

| Hollow Quad Pipe (Stainless 50 X 20 X 2 mm) | 4 | 50,000 | 200,000 |

| Hollow Circular Pipe (Stainless) | 4 | 25,000 | 100,000 |

| Labour + fixtures | 1 | 500,000 | 500,000 |

| Total | 2,437,000 | ||

- water from the ground tends to be contaminated with all kind of natural salts, molecules, and elements. To acquire neutral water, the water will pass through a reverse osmosis process with the help of the purification machine shown in figure 15 below. The price varies at about ₦6,000,000.

4.1.7 Labor and Engineering Fees

- Electrical, mechanical, and civil contractors

- Solar + electrical system design and commissioning

-

Technical documentation, inspection, and testing

- Estimated Total:

- $5,000 – $10,000

4.1.8 Logistics and Import Duties

-

International shipping of container, ASICs, solar panels

-

Port clearance, inland transport to Kano

-

Customs duties, taxes, agent fees

-

Customs Duty (Nigeria):

-

Varies ~5–20% depending on equipment

-

Budget margin: ~7.5% of equipment cost

-

-

Estimate:

- $29,183

4.1.9 Capex Summary

Figure 16: Capital Expenditure Breakdown

| Section | Cost | |

|---|---|---|

| USD ($) | NGN (₦) | |

| Site Preparation and Construction | - | 62,909,300 |

| Office and lab equipments | - | 3,085,000 |

| Bitmain Containers and ASICs | 389,100 | - |

| Batteries, Solar Panels, Inverters, Transformers | 215,345 | - |

| HVAC cooling | - | 18,917,500 |

| Liquid Cooling System | - | 8,437,000 |

| Labor and Engineering Fees | 7,500 | - |

| Logistics and Import Duties | 29,183 | - |

| Total | 641,128 | 93,348,800 |

At 1,600 ₦ /$, the GRAND TOTAL: $699,471

4.2 Operational Expenditure (OPEX)

4.2.1 Electicity Cost

Total ASIC Power Load:

30 units × 5,676 W = 170.28 Kw

Including Cooling Systems, RO Units, and Safety Margin (~10%):

Total Continuous Load ≈ 187.308 Kw

Yearly Energy Requirement:

187.308 Kw × 24 hours x 30 days x 12 months = 1,618.34 MWh/year

Yearly Energy Cost: only 60% of the energy will be sourced from solar energy for starters, while the rest will be procured from KEDKO. thus:

1,618.34 MWh x 224,000 ₦/MWh x 0.4 ≈ ₦145,003,364

At the rate of 1600 ₦/$, the total is:

₦145,003,364 / 1,600 ₦/$ ≈ $90,627

4.2.2 Maintenance of Miners & Cooling

ASINC maintainance: ~ $150–$200 /year per ASIC miner

For 30 miners:

$200 × 30 = $6,000/year

Cooling system (pumps, RO filters): ~2–3% of equipment CAPEX annually cooling capex at 11,823:

$11,823 x 2% = $236.5/year

4.2.3 Staff Salaries

| Employee Role | Monthly Salary (₦) | Number of Workers | Total Yearly Salary (₦) |

|---|---|---|---|

| Manager | 450,000 | 1 | 5,400,000 |

| Mechanical Engineer (Fabrication) | 300,000 | 1 | 3,600,000 |

| Electrician | 300,000 | 1 | 3,600,000 |

| Technicians | 120,000 | 2 | 2,880,000 |

| Security | 50,000 | 4 | 2,400,000 |

| Lab Technician | 150,000 | 1 | 1,800,000 |

| Casual workers | 40,000 | 3 | 1,440,000 |

| Total | 21,120,000 | ||

At the rate of 1600 ₦/$, the total is:

₦21,120,000 / 1,600 ₦/$ ≈ $13,200

4.2.4 Internet & Network Services

Starlink: $43/month (as of Nigeria rates)

Local ISP backup: $20–$30 USD/month

Router maintenance: $100/year

Annual: ~$1,000/year

4.2.5 Insurance & Security

Equipment insurance (Include fire/theft/policy costs): 1–2% of CAPEX

Fixed Assets = Total Capex - Labor and Engineering Fees - Logistics and Import Duties

Fixed Assets = $699,471 - $7,500 - $29,183 = $662,788

Insurance = $662,788 x (2/100) = $13,256

4.2.6 Spare Parts & Consumables

Budget (Fans, cables, hoses, filters): 2–3% of mining equipment cost/year

Est: $6,102/year

4.2.7 OPEX Summary

| Section | Anual Cost ($) |

|---|---|

| Maintenance & Spearparts | 12,339 |

| Electricity (at 60% solar) | 90,627 |

| Fixed Costs(Overheads and Bills) | 14,200 |

| Insurance | 13,256 |

| Total | 130,422 |

5.0 Profit Projections

5.1 Profit & ROI

The folling calculations are Based Purely on the Initial setup and does not account any reinvestemnt strategies.

The total expected revenue generated from Bitcoin mining is directly related to the contributed computational power, measured in hashrate — the number of cryptographic guesses a miner can make per second. In Bitcoin mining, the probability of successfully mining a block (and earning a reward) is proportional to a miner’s hashrate relative to the total network hashrate.

The Reward Per Hash represents the expected revenue earned per individual hash attempt. It is typically calculated by dividing the total block reward (in monetary terms, including transaction fees) by the expected number of hashes required to successfully find a block — a value determined by the current mining difficulty. This metric provides a probabilistic estimate of how much revenue can be earned per unit of computational effort.

Figure 17 below illustrates the revenue obtained from a Bitmain Antminer S21 XP Hydro, which operates at a rated hashrate of 473 TH/s, over the past six months.

Figure 17: Bitmain Antminer S21 XP Hydro Miner Revenue with a hashrate of 473 TH/S

Using the average revenue for the past 6 months we can calculate an approximate Reward Per Hash:

- If a miner earned $25.525 and the BTC price is 104,200 USD/BTC, then the miner earned:

BTC Revenue = $25.525 $ ÷ 104,200 USD/BTC ≈ 0.000245 BTC

- Since that revenue was generated using 473 TH/s over one day (86,400 seconds), then:

473 TH/s = 473 × 10¹² hashes per second

Total Hashes = 473 × 10¹² × 86,400 = 4.08672 × 10¹⁹ hashes

- The BTC and USD per hash is:

Reward Per Hash (in BTC) = 0.000245 BTC ÷ 4.08672 × 10¹⁹ ≈ 6.0 × 10⁻²⁴ BTC/hash

Reward Per Hash (in USD) ≈ 6.0 × 10⁻²⁴ × 104,200 ≈ 6.25 × 10⁻²⁰ USD/hash

Yearly revenue for 30 miners:

revenue = Number of miners x Reward Per Hash (in USD) x Total Hashes per day x 365 days

revenue = 30 x 6.25 × 10⁻²⁰ x 4.08672 × 10¹⁹ x 365

revenue = $275,670

Annual Profit:

= Revenue - Annual Operating Cost

= 275,670 - 130,422

= $145,248

5.2 Reinvestment strategies

The following projections for the reinvestment strategy were calculated using the previously established starting point, along with the following assumptions:

-

The Bitcoin price is held constant at its current value throughout the 3-year simulation.

-

Dividend payouts are fixed at 15% during the reinvestment period.

-

The reinvestment period spans the first 11 months of the simulation.

-

The reinvestment strategy prioritizes energy efficiency, specifically by increasing the share of solar-generated power from the initial 60%.

The resulting projections are outlined below:

Figure 18: Average OPEX Distribution

Figure 19: Financial Position

Figure 20: Power Requirements

Figure 21: Stored Energy

6.0 S.W.O.T Analysis

- Low Operating Costs: Relatively affordable land and labor in Kano reduce overhead.

- Tailored Infrastructure: Purpose-built mining setup optimized for Bitmain ASICs, ensuring maximum hashrate and uptime.

- Scalability: Facility design can accommodate scaling with additional ASIC units.

- Technical Expertise: Completed study indicates deep understanding of local grid and mining tech.

- Potential for Off-Grid Power: Abundant sunlight supports solar/hybrid setups for long-term cost savings.

- High Initial Capital: ASIC hardware and cooling infrastructure are expensive.

- Energy Demands: ASICs require consistent high-power input; stress on grid or need for custom generation.

- Heat Management: Kano’s high ambient temperature challenges cooling systems.

- Maintenance Needs: Dust, heat, and voltage fluctuation may increase hardware failure rate.

- Specialized Skill Requirement: Running mining operations needs experienced operators and electricians.

- New Legal Recognition of Digital Assets (2025): Crypto now has legal backing under Nigerian law, opening doors for institutional investments, regulated growth, and investor confidence.

- Solar Integration: High solar irradiance supports hybrid/solar energy to reduce grid reliance.

- Rising Bitcoin Adoption: Potential for long-term profitability as demand for BTC increases thus driving the price.

- Cheap Renewable Projects: Government or private incentives for renewable power infrastructure.

- Unstable Grid: Frequent outages, surges, and inconsistent supply from regional power providers.

- Regulatory Uncertainty: Nigeria's shifting stance on crypto could impose sudden restrictions.

- Crypto Market Volatility: Profitability swings heavily with BTC price and network difficulty.

- Import Constraints: Customs delays, duties, or restrictions on ASIC hardware and cooling tech.

- Naira Inflation: Currency devaluation impacts cost of imported goods and ROI calculations.

- Market Shift to Proof-of-Stake (PoS): Increasing global momentum toward energy-efficient blockchains may reduce long-term viability of ASIC mining.

7.0 Summary

This report presents a financially and technically grounded Bitcoin mining initiative in Kano, Nigeria. The operation combines cutting-edge ASIC technology with a well-defined path toward solar power integration. Profitability is demonstrated through detailed financial modeling, including both baseline and reinvestment projections. The strategy emphasizes resilience—addressing regulatory, environmental, and operational challenges while seizing opportunities in a maturing African digital economy.

Key highlights include:

-

Initial Year Profit: $145,248

-

3-Year Net Profit (with reinvestment): $478,845

-

Projected ROI: 68.5%

-

Solar Power Penetration by Month 11: 93%

-

Capital Expenditure (CAPEX): $699,471

- Monthly Profit with a Reinvestment strategy of $13,301:

- An average of $2,202 for ther first 11 months

- An spike to $20,2007 on month 12 due to injection from unrealized investment funds

- A monthly profit of $18,109 from month 13 to 36

This investment offers strategic exposure to the cryptocurrency mining industry, anchored in a forward-looking model that prioritizes renewable energy integration, infrastructure scalability, and long-term sustainability. Backed by detailed financial projections and a reinvestment strategy that accelerates profitability, the venture provides a structured pathway into the global digital asset ecosystem — with strong local development impact and clear, data-driven ROI potential.

8.0 Appendix

-

Irradiance Map